A look into managing finance

Money management has been something that a lot of people do think about but only a

few actually practice.

I will be looking into the psychology of saving money and how one might approach

saving and management, how they can be encouraged how they would like to be

rewarded. I will be looking into how we can create an application that will

encourage and help a person to become better at managing their money. specially two

avenues how to bring someone who do not practice management into the application and

make him interested in it and how to bring someone who already likes to manage their

money and make it easier for them

Problem

Money management is a concept that most people are not accustomed to and with the

state of the economy and all most people are looking into saving money and managing

money. Being a fast phase moving world not everyone has the time to learn a new

skill. And the current population being used to instant gratification it is hard for

an action such as saving money which is a step by step long process.

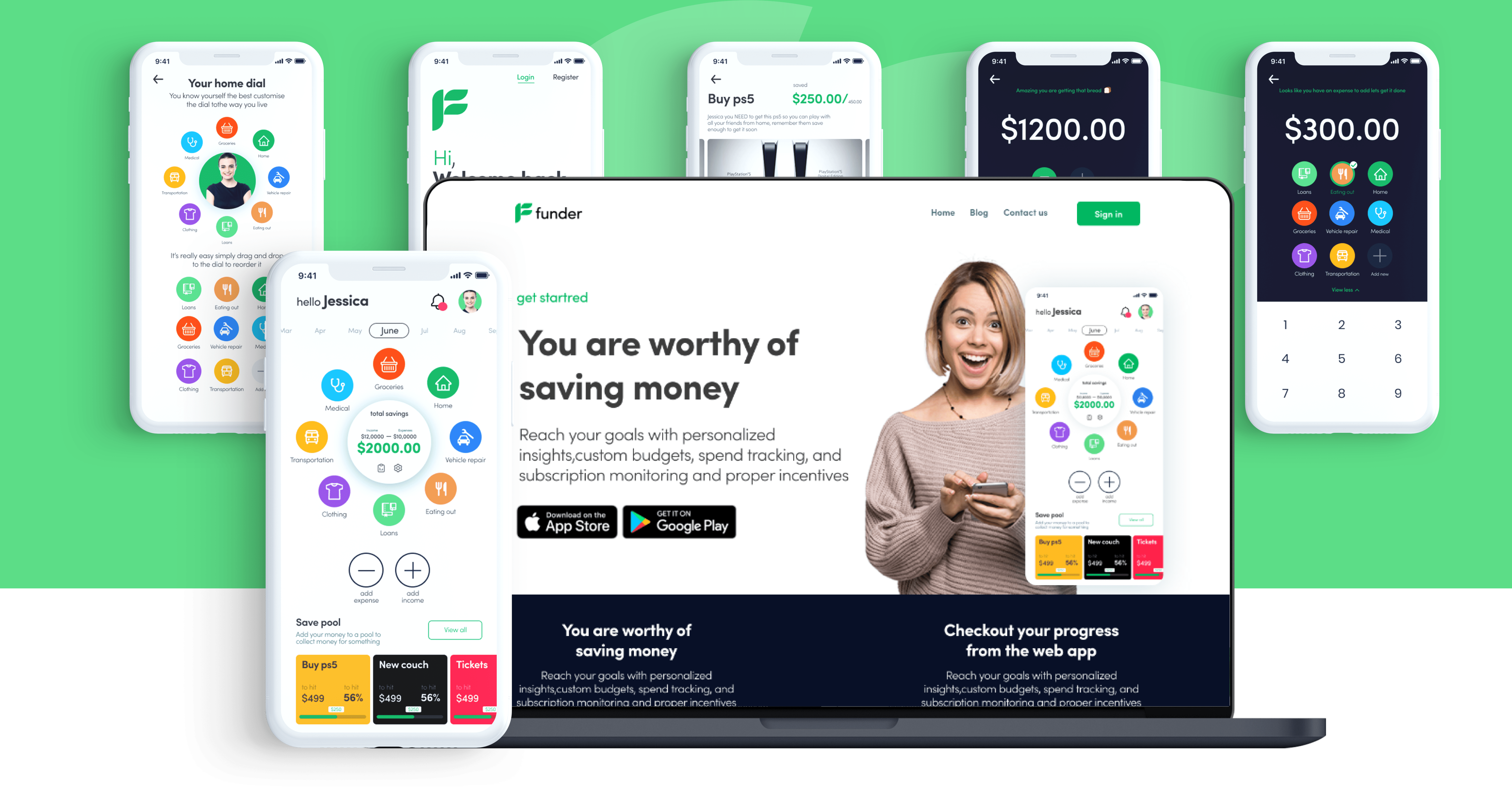

Solution

Create a mobile application and a supporting web application to trach the users'

money and have a way where the user can allocate his or her finances for specific

things, if the user wants to save to buy a new laptop the application should support

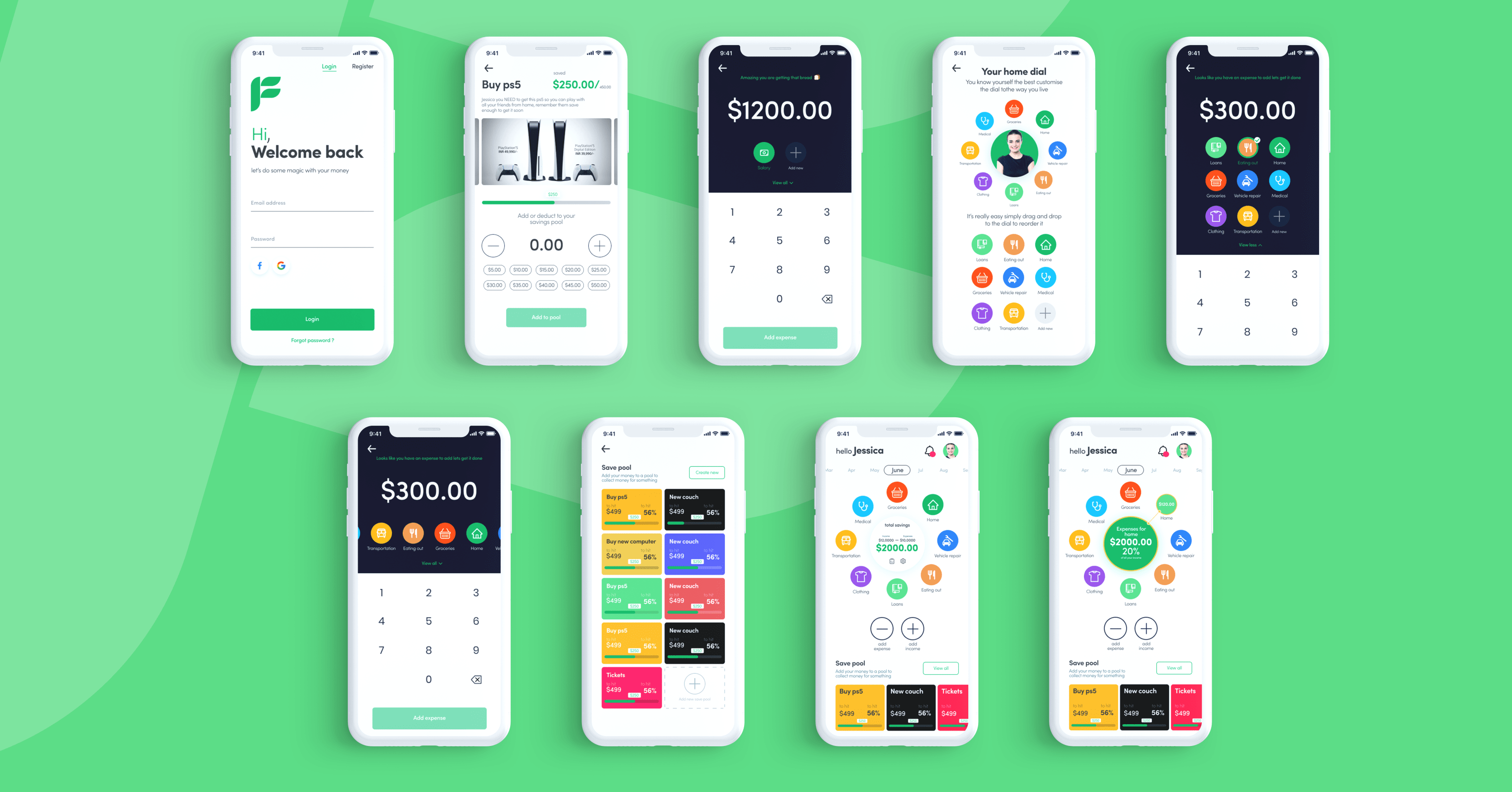

My Design Process

The creative design process is the method I follow that helps me to understand test and iterate to

improve the product.

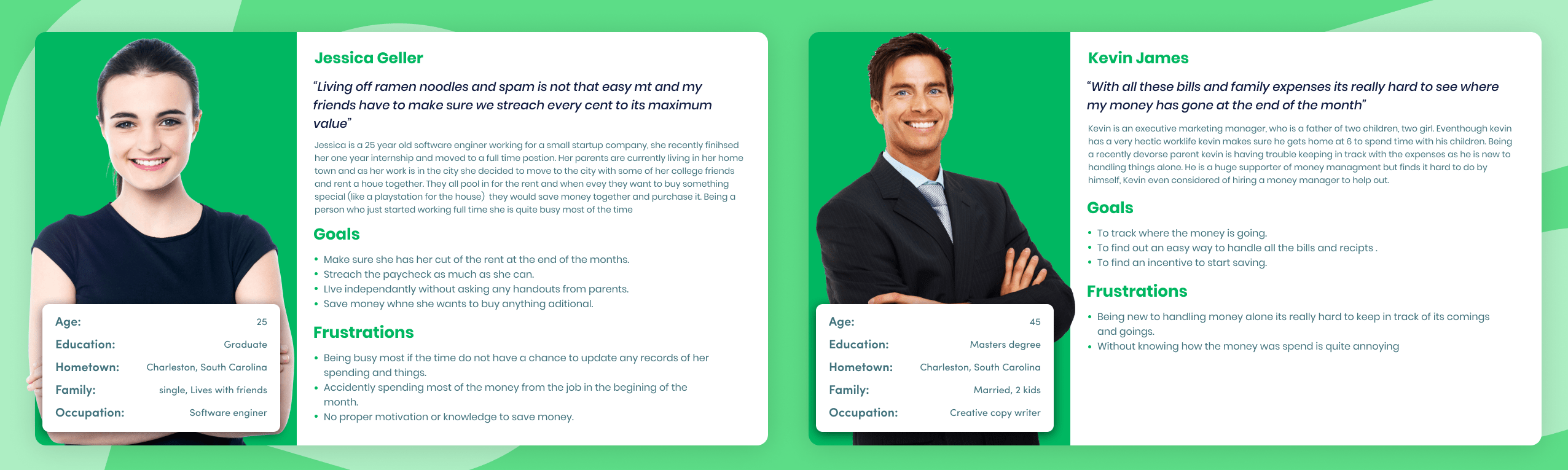

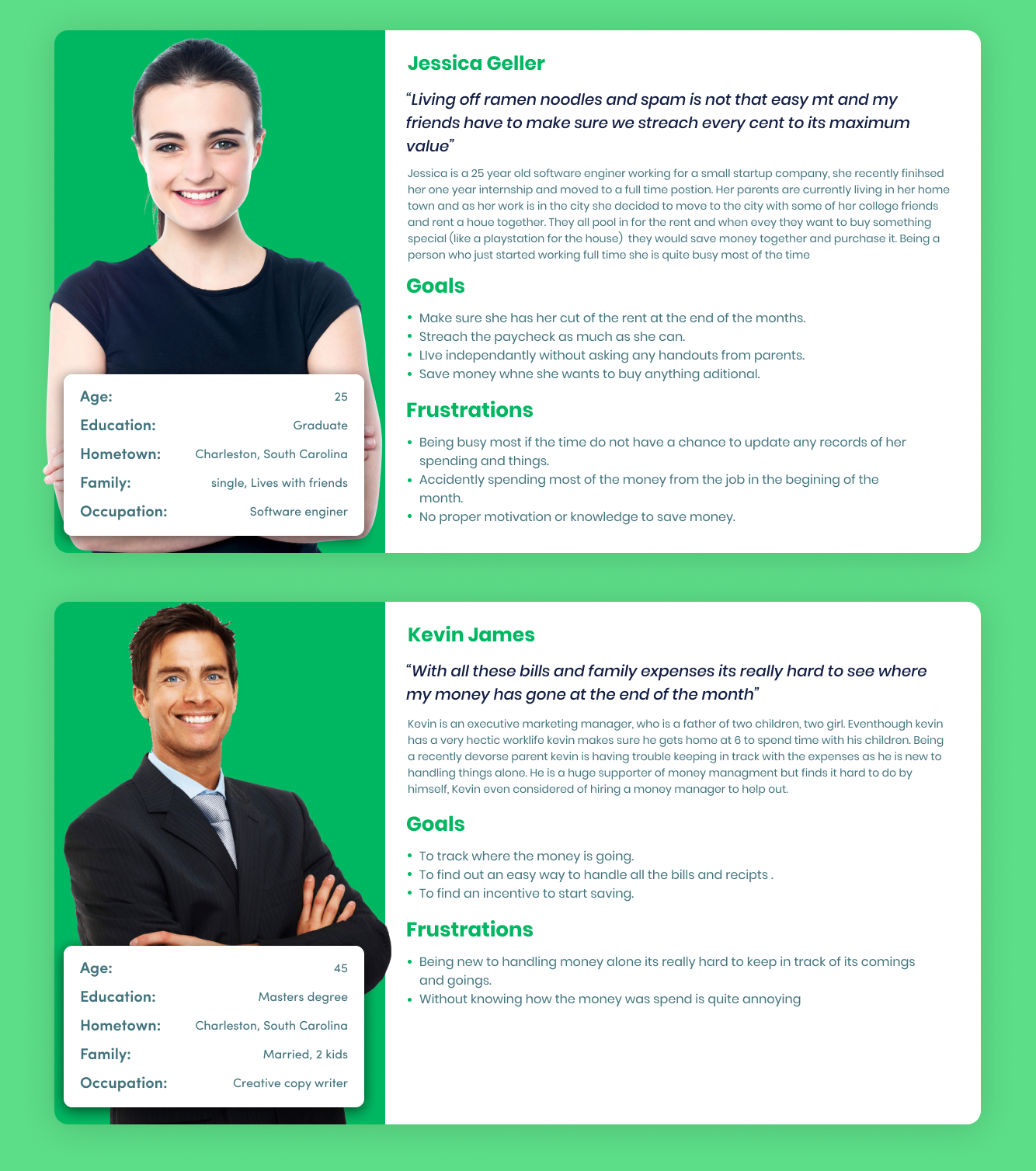

Target group

From the majority of the research, I quickly understood that the group of individuals we need to

target is not the sections who do not wanna save it's the individuals who like to save but do

not have a clear way of helping them do it

Group 1

Young adult professionals who are starting to make money (entering into the workforce)

- Mainly involved with internships and entry-level positions because of that they do not possess a lot of money for things

- Most of the time staying with friends together there for have to manage their finances to make sure they cover everything

- Sometimes get the chance to earn extra money

- Have to save money to buy almost anything special

Group 2

Adults who are interested in personal finance

- Already possess a certain amount of money and capital

- Already has a spending habit they have been following for a certain amount of time

- From time to time need to purchases where they need to save up for

- With families and other responsibilities do not have the time to always check how his or her money moves

Research findings

- Have a monthly breakdown to show what they spent on and all (Might be good but that is what every application will try to do apart from it there needs to be a better way to encourage a user )

- We could use positive visual messages to incentivize saving

- Giving the user one or two tips at the end of the month depending on his or her spending patterns

- Giving a reminder

- Users should be able to customize the application to their liking they should be in control.

- Should be able to see the remaining money at a glance

- Should be able to show at a glance what they have spent on things as a ratio (majority of the spending on what and all)

- Should be able to set up save pools to save for specific things the user would like

Thoughts from users that already save

- They think about the future : by imagining the future in a way they move to saving not by thinking only things will get better i will save when things are better but by thinking if everything stays the same for longer i need to save

- They find a saving method that works for them : One trick that’s helpful is to divide a large amount into smaller chunks. “If you break up savings into smaller, more manageable goals, it quadruples how much people are willing to save,” said Sharma. “And, people continue with it.”

- They find a way of saving that is not only cutting out spending : People can shop for sales, use coupons for lower prices on goods and do research to find the best price for an item before making a purchase.

- Realising that earning is not the only way of saving

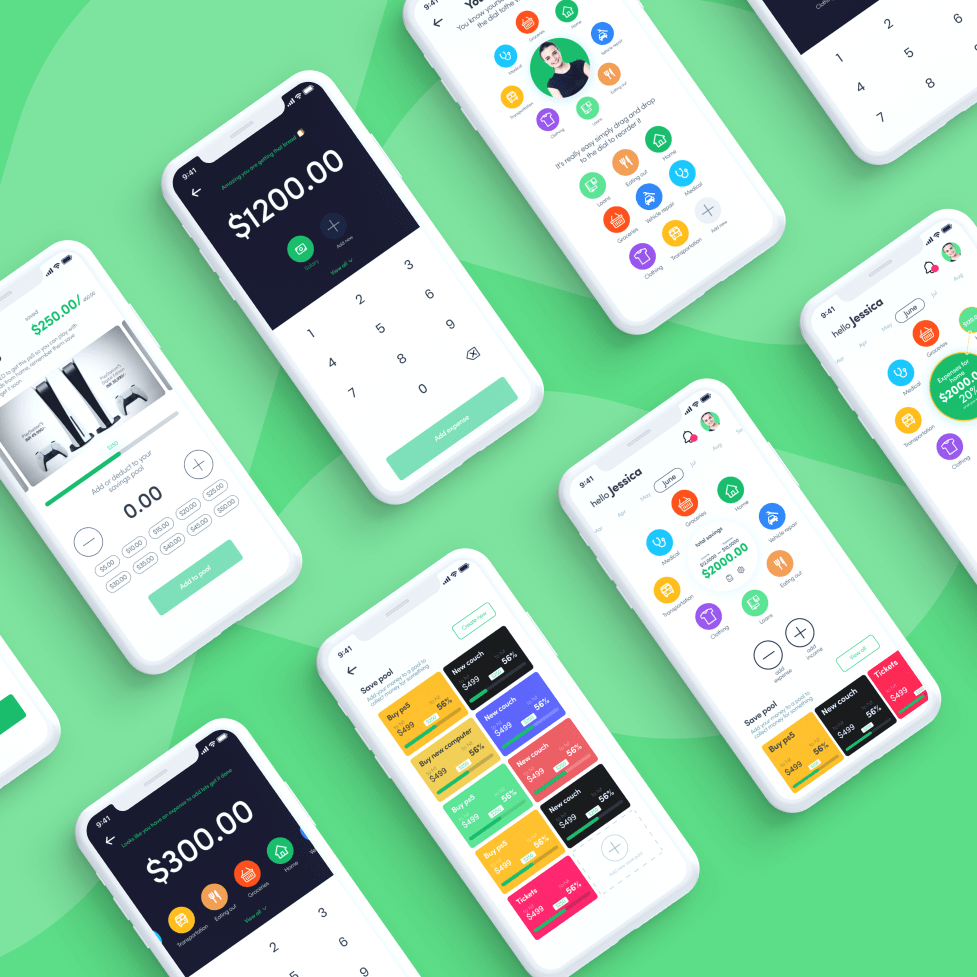

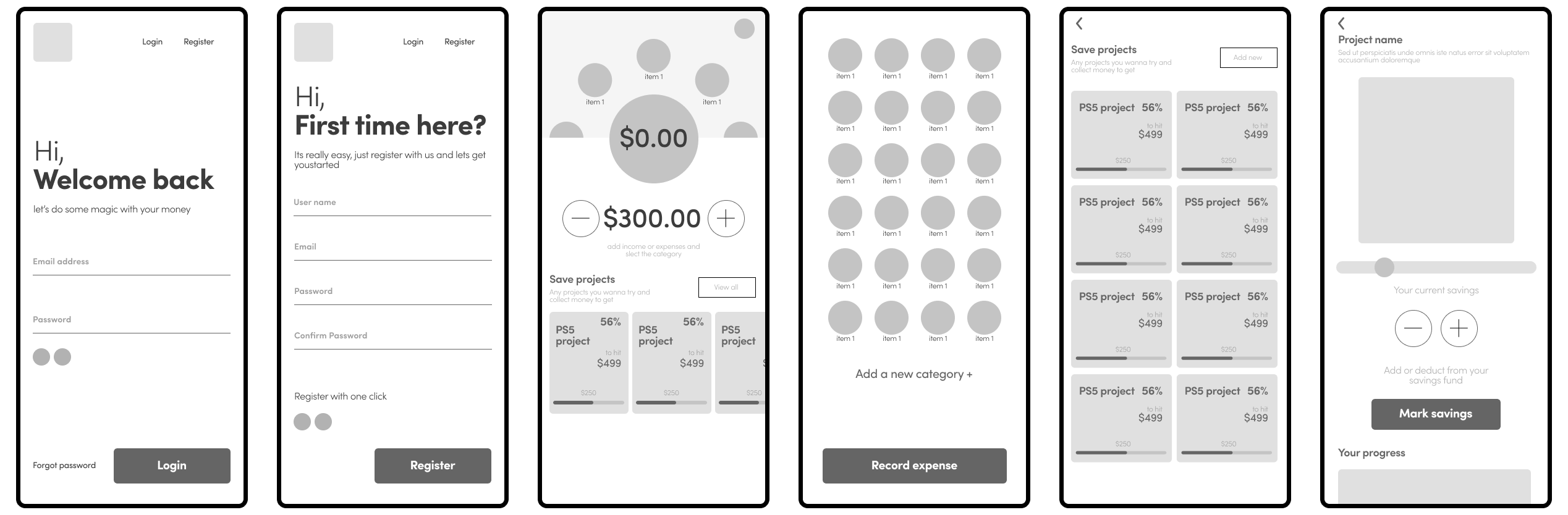

Initial Wireframes

After ideating different solutions, the selected was taken and digital wireframes were created.

Which was sent through a usability test in order to find any issues and iterate to make the

solution better

Research plan and usability study

The application was sent through to the usability study to see what are anything was missing any

functions that were too complicated or anything that might be an issue going forward. I was able

to gather a good number of data and iterate on some screens to match the user needs better

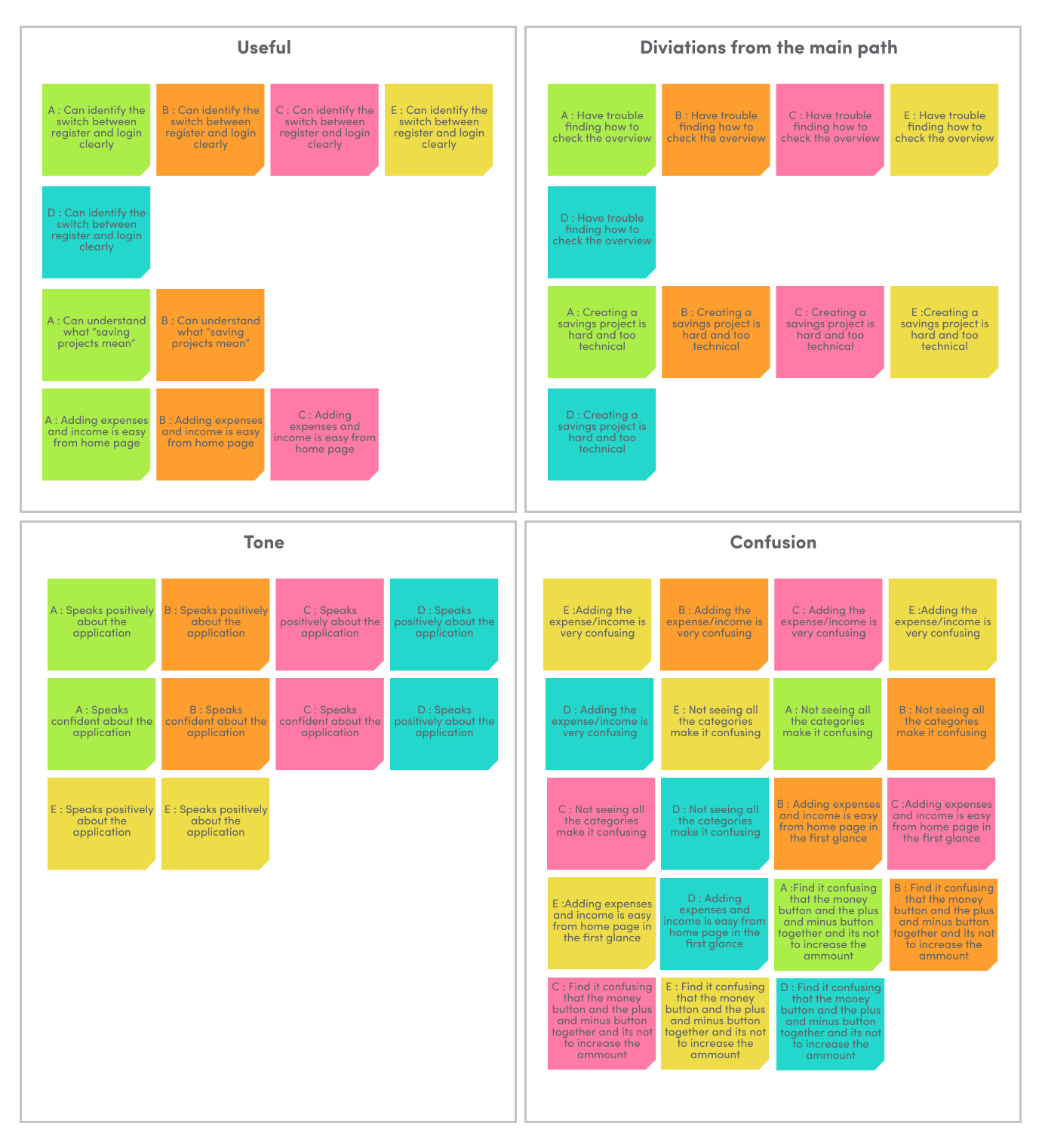

All the observations gathered from the sessions were put into an affinity diagram to make it

easier to understand what are the common theses that I am able to uncover so I can

prioritize on understanding which sections should I be focusing more on

key insights from the usability study

Need to improve the UI so it's very clear that the user is adding a certain amount

of income or expenses

All the major categories need to be visible on the page at once, a user should not

have to scroll to see them all

Having the overview check by having to long-press on the dial has something they all

missed adding icons there might translate better

Need to improve the UI so its very clear that the user is adding a certain amount of

income or expenses

Creating a save pool should be much simpler having a process where the user can fill

out the blanks of a sentence might be good..

Having the number in between and the plus/minus button besides confused most of the

users, as they thought the + and - were to add and subtract the value

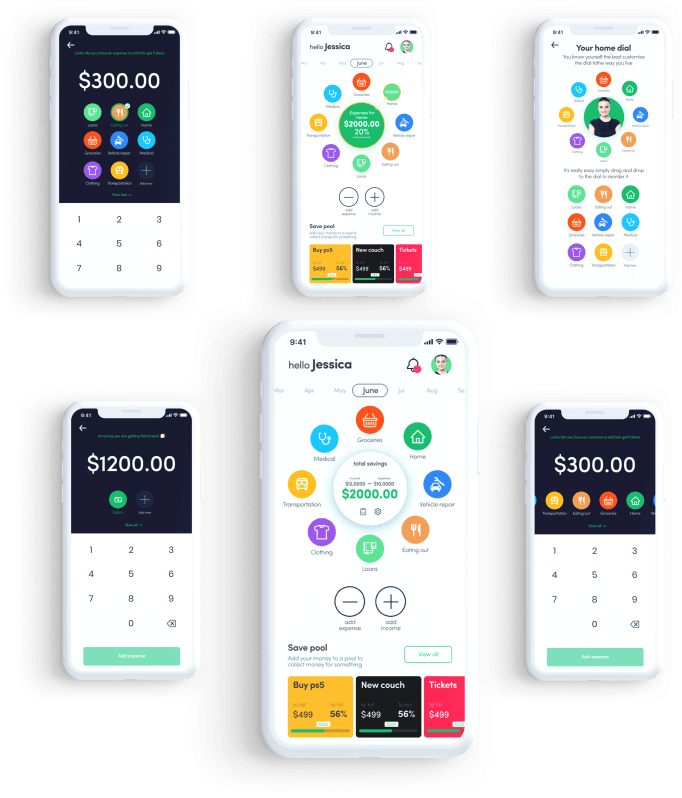

Home page

The process of the home screen is very simple

At a glance, the user can see his savings his income and his expenses, around are all

the

expenses the user has selected and customized for him or herself.

Upon clicking each category the user is able to see a quick breakdown of that

particular expense

the savings are broken into months to make it easier to hand and the user can easily

swipe and see his previous records

The + and the - buttons are right below for adding the incomes or expenses with

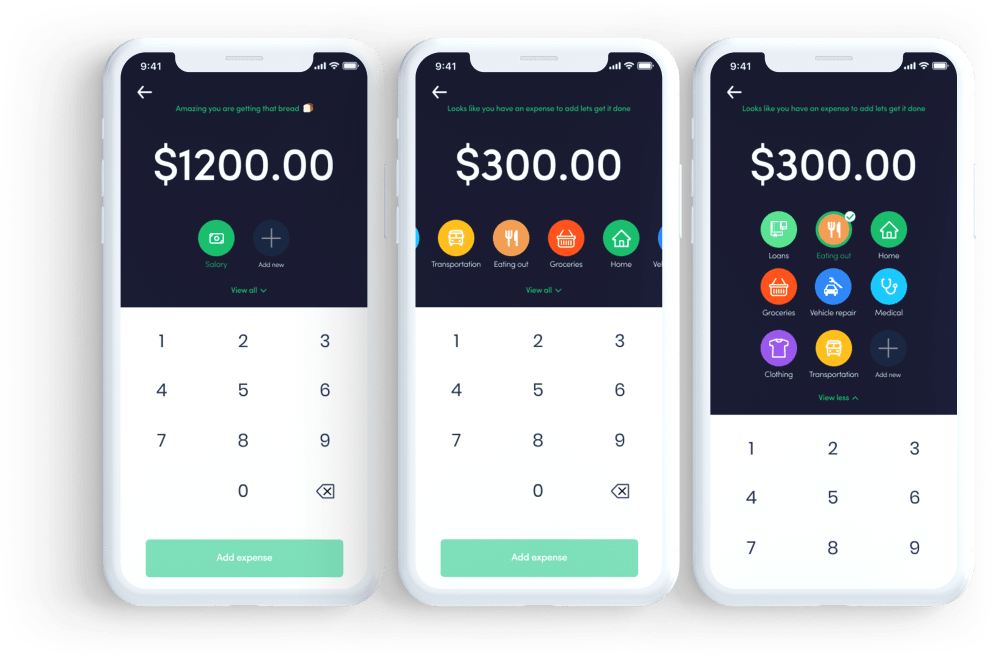

Recording expenses and income

Recording income and expenses should be the most simple function, from the usability

study before I understood that the user would prefer to have an extra click over being

confused at the start of the process itself so this way the user can easily indicate the

amount select what category

( add a category if he or she can't find what is needed ) and mark the income or expense